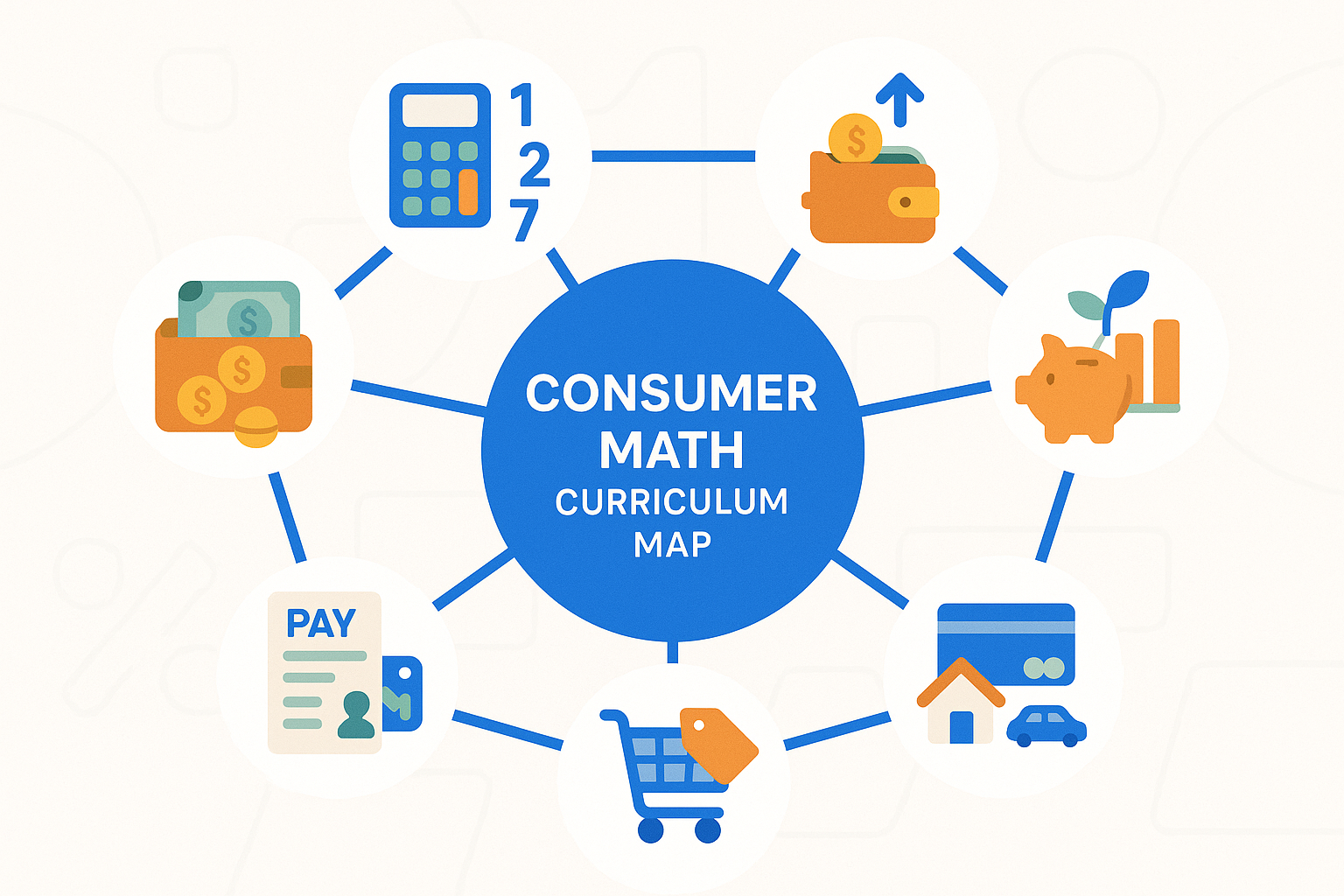

What Is Consumer Math?

Consumer math is a practical mathematics course that teaches essential personal finance skills for everyday life, covering budgeting, taxes, interest calculations, credit management, and smart shopping strategies for real-life applications.

Understanding the Basics

This foundational consumer math course emphasizes practical applications over abstract theories, preparing high schoolers for real-life financial decisions.

Core Concepts of Consumer Math

Consumer math prioritizes real-life applications, teaching fractions, decimals, and percentages as tools for calculating tips, sale prices, and interest rates.

How It Differs from Traditional Mathematics Courses

Unlike algebra or calculus, consumer math focuses on practical life skills like budgeting and taxes rather than theoretical proofs.

Historical Background and Evolution

Consumer math emerged as educators recognized the need for practical personal finance education in modern society.

Emergence in High School Programs

Educational standards shifted toward practical skills as high school recognized students needed real-life financial knowledge before graduation. See our policies for full-time students for details.

Role of Adult Education Programs

Community colleges offer consumer math courses for adults returning to education or seeking essential finances management skills.

Key Topics Covered in Consumer Math Course

The curriculum spans essential financial topics from basic mathematics review to complex investing strategies and tax calculations.

Mathematics Review for Real-Life Contexts

Fractions calculate recipe adjustments, decimals determine prices, and percentages help compute tips, taxes, and interest rates.

Budget and Money Management Fundamentals

Students learn tracking expenses, categorizing spending, setting savings goal, and creating sustainable monthly budget for financial stability.

Budget and Money Management in Depth

Advanced budgeting techniques help high schoolers master personal finance through systematic planning and careful expense tracking methods.

Creating and Maintaining a Personal Budget

Fixed expenses like rent contrast with variable costs like entertainment, helping students set achievable financial goal.

Analyzing Income vs. Expenses

Wages calculations, hourly wages computations, and discretionary income analysis help students understand their true financial position.

Exploring Savings and Investing

Understanding interest calculations and investing option empowers consumers to build wealth through informed financial decisions over time.

Simple vs. Compound Interest

Simple interest grows linearly while compound interest accelerates growth, as demonstrated through savings account examples.

Long-Term Strategies and Financial Goals

Stocks, bonds, and retirement accounts offer different risk levels, encouraging consumers to plan for future financial security.

Credit, Loans, and Mortgages

Responsible credit use and understanding loan structures help consumers navigate major financial commitments throughout their life.

Understanding Credit Scores and Types of Credit

Revolving credit differs from installment loans, and responsible credit usage builds creditworthiness for future financial opportunities.

Mortgage Basics and Amortization

Down payments, closing costs, and monthly payments split between principal and interest determine long-term homeownership costs.

Payroll and Taxes

Understanding paychecks and taxes obligations helps consumers manage their income effectively and meet legal requirements properly.

Withholding and Tax Rates

Federal and state taxes vary by income brackets and filing status, affecting take-home wages calculations.

Introduction to Payroll Deductions

Social Security, Medicare, insurance, and retirement deductions reduce gross wages to determine net income.

Sale Prices, Markups, and Comparison Shopping

Mathematics skills help consumers save money through smart shopping decisions and understanding retail prices strategies effectively.

Analyzing Retail Prices Strategies

Discounts, coupons, sales tax, markups, and profit margins all affect final prices consumers pay at checkout.

Practical Tips for Savvy Consumers

Unit pricing comparisons, bulk buying calculations, and avoiding impulse purchases help stretch budget further while shopping.

Consumer Math vs. Financial Literacy

While related, these courses offer different approaches to personal finance education with distinct focuses and teaching methods.

Common Ground and Overlapping Skills

Both emphasize money management skills and real-life financial awareness essential for adult financial independence and success.

Key Distinctions Between the Two Courses

Consumer math course emphasizes computational skills while financial literacy focuses on behaviors, mindsets, and decision-making processes.

Integrating Consumer Math Into Various Learning Environments

Effective implementation requires diverse teaching strategies adapted to different student populations and educational settings across various platforms. Schools can explore our high school curriculum for schools.

Effective Teaching Strategies and Resources

Project-based learning, real-life simulations, online calculators, textbooks, and practical worksheets enhance student engagement and understanding. See our Ask the Teacher for Money Math for support and tutoring options.